All the qualities to be the

best service agent

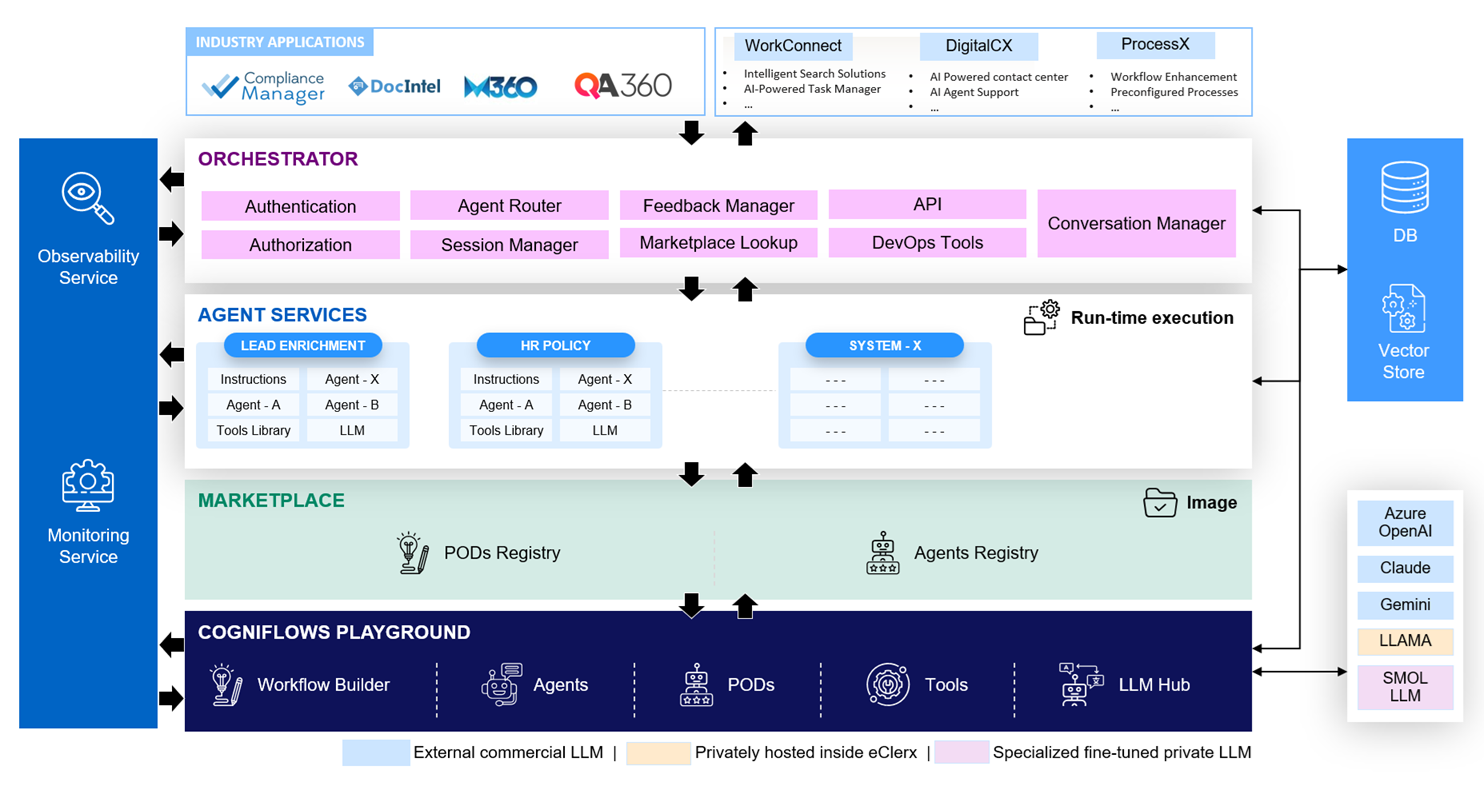

By combining Agentic AI and RPA, CogniFlows orchestrates intelligent workflows, resolves exceptions in real time, and continuously improves performance—delivering speed, accuracy, and scale with control.

-

Natural Language

Training -

Goal-Oriented

Behavior -

Autonomous

Execution -

Continuous

Optimization -

Multi-Agent

Collaboration

Explore

Explore